Every second counts. But what if the jet itself could read the pilot’s stress levels, anticipate their next move, and adjust its behavior to ensure optimal performance, even when the pilot is running on fumes?

Welcome to the world of Neuroadaptive Trading Systems — the high-tech co-pilot for the modern prop trader.

In the high-stakes arena of proprietary trading, also known as prop trading, where firms use their own capital to make aggressive market bets, every decision can mean millions. It’s a battlefield of algorithms, human instinct, speed, and razor-sharp precision. Traders in this environment often operate under immense pressure, juggling multiple screens, market signals, and volatile data streams. But even the sharpest minds fatigue. The human brain, for all its brilliance, is not immune to emotional swings, cognitive overload, and burnout.

That’s where Neuroadaptive Trading Systems enter the scene.

Think of them as an invisible exosuit for the trader’s mind. These systems use AI models fused with neurofeedback technologies—like EEG sensors and biometric trackers—to monitor the trader’s brainwaves, heart rate, focus levels, and emotional states in real time. They don’t just watch; they adapt. When cognitive fatigue sets in, the system can adjust the trading interface: dimming distracting data, slowing the information feed, or even alerting the trader to take a break. If stress or impulsivity spikes, it may temporarily freeze high-risk trading buttons or re-route decisions to pre-approved strategies.

Now imagine this applied to a prop trading desk—a fast-paced environment where a trader might manage 10 or more screens, dozens of indicators, and high-frequency models running side-by-side. Neuroadaptive systems become a tactical asset, quietly syncing with the trader’s mental state, smoothing out the jagged edges of human performance.

But there’s more. These systems learn.

Just as a seasoned coach learns an athlete’s limits and strengths, Neuroadaptive Trading Systems build a cognitive map of each trader over time. Are you more focused in the mornings? Do you make riskier decisions after lunch? Are you prone to hesitation under pressure? The system logs it all, personalizing responses to fit your unique trading rhythm.

This is not just a luxury. In prop trading, where traders often operate with the firm’s capital and are expected to deliver results consistently, mental sharpness is currency. And unlike retail traders who might dabble at their own pace, prop traders can’t afford to make emotionally-driven decisions. Mistakes don’t just hurt their portfolio—they can affect the firm’s bottom line.

And let’s not forget risk management. If a trader’s mental state suggests high likelihood of irrational behavior—say, chasing losses after a streak—systems can limit their exposure or flag supervisors. It’s risk management not just by numbers, but by neuro-response.

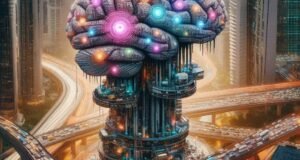

In short, Neuroadaptive Trading Systems are redefining human-machine synergy in finance. They blur the line between trader and tool, transforming the trader into a cybernetic entity, more efficient, more focused, and less prone to the weaknesses of human emotion.

As prop trading firms look for the next edge—beyond algorithms, beyond faster execution—this fusion of neuroscience and AI may very well be the secret weapon. Because in a world where milliseconds matter, and every decision has weight, the calmest mind often wins.

And now, thanks to Neuroadaptive Systems, calm can be engineered.