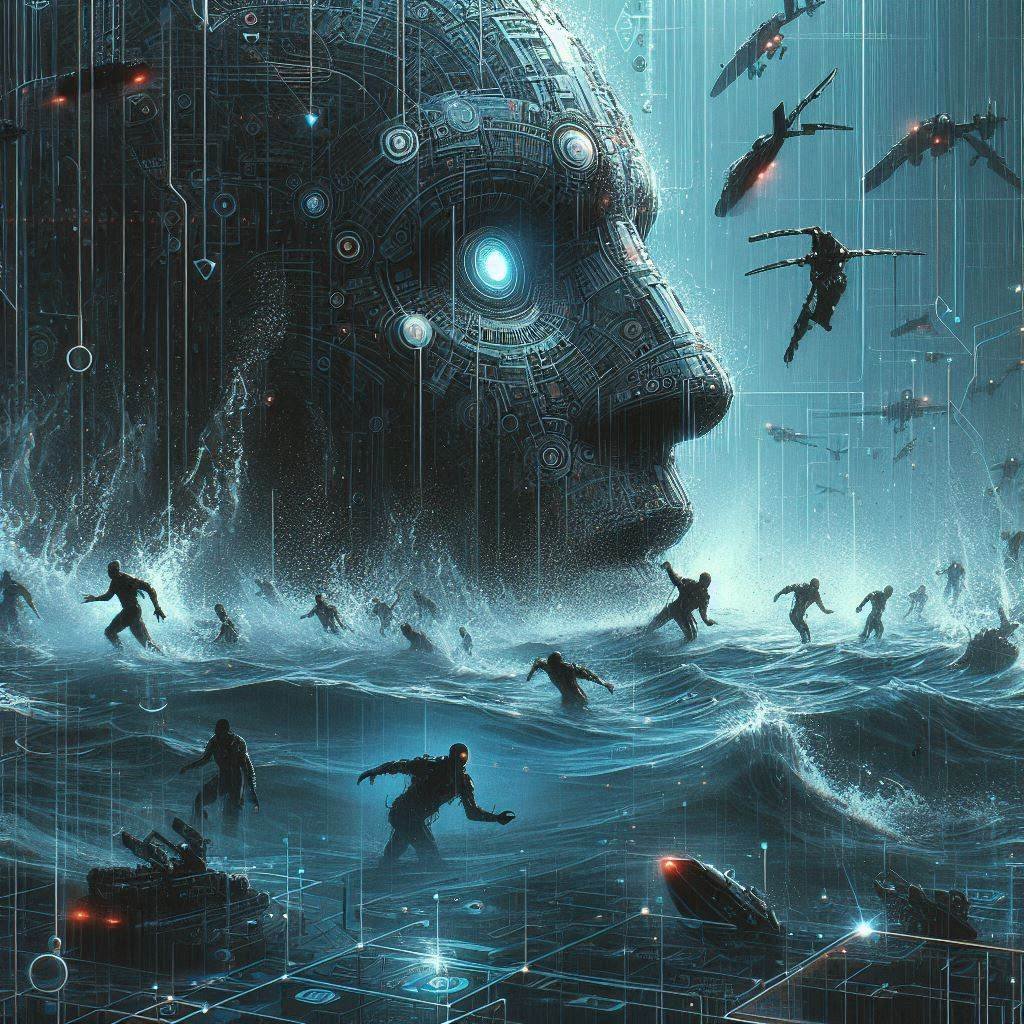

Picture a grand chessboard—but the room is dim, the pieces are invisible, and the opponent is silent. You don’t see their moves directly. You only notice, over time, that your queen is under threat or your knight is boxed in. This is the game prop trading firms play daily when they engage with dark pools—private, off-exchange venues where institutional giants make stealthy moves.

Here enters Dark Pool Footprint Tracking—an elegant strategy, where algorithms don’t just chase prices; they infer the intentions of whales beneath the surface, like sonar detecting silent submarines.

But let’s walk through this with a narrative—objections, responses, and revelations, all wrapped in a metaphorical cloak.

Objection 1:

“Dark pools are invisible. How can you track what you can’t see?”

Response:

You can’t see the wind either, yet sailors navigate storms using the ripple of waves and the tension in the sails. Similarly, prop trading algorithms track market imbalances, volume anomalies, and liquidity shifts to estimate the movements of institutional players.

These algorithms are trained not just on data—but on patterns of absence and presence. A large order executed with no corresponding price movement? That’s not silence—it’s a signal. A sudden stall in market flow? That’s a shadow of something big moving through the depths.

In prop trading, where every edge counts, sensing these unseen ripples becomes a decisive advantage.

Objection 2:

“Isn’t this just guesswork? Isn’t it risky to base strategies on assumptions?”

Response:

All trading involves assumptions. The difference in prop trading is the quality and discipline behind those assumptions.

Think of Dark Pool Footprint Tracking like tracking animals in a forest. You don’t need to see the lion—you recognize its paw print, the bent grass, the stillness of birds. Prop traders aren’t throwing darts in the dark; they are building probabilistic models based on real microstructural clues, honed by machine learning and historical behavior.

It’s not reckless guessing—it’s refined deduction, calibrated with every tick of the market.

Objection 3:

“If this works, wouldn’t everyone use it? Doesn’t it cancel itself out?”

Response:

Here’s the twist—dark pools are designed not to scale easily. The more traders chase the same shadows, the more the signal distorts. That’s where proprietary trading thrives—through exclusive models, deep domain knowledge, and execution finesse.

What makes Dark Pool Footprint Tracking a true prop trading asset is its custom nature. Each firm’s models are different. Some track post-trade tape anomalies; others build network graphs of liquidity fragmentation.

The Bigger Picture

Imagine a crowded theater where the lights go out, and yet, one trained observer starts noticing shifts—the creak of a floorboard, the faint smell of smoke, the hushed whispers of movement. While others sit frozen in the dark, the observer moves with purpose, ahead of the danger or toward opportunity.

That’s Dark Pool Footprint Tracking in the world of prop trading. It’s not reactive. It’s anticipatory. It allows firms to act where others only guess.

It also solves a deeper issue: information asymmetry. Institutions trading in dark pools do so to avoid revealing intent—but prop trading firms, through intelligent inference, rebalance the game. They don’t need full information—they need just enough friction in the surface to predict the deep currents.

In a world where markets are flooded with noise and speed, proprietary trading stands apart by seeking clarity in shadows, not just light. Dark Pool Footprint Tracking is a testament to that philosophy—transforming invisibility into insight, and uncertainty into edge.

For those who master it, the ocean of dark liquidity doesn’t remain dark for long. It becomes a map of intentions, power, and profit.